Leave Your Message

In the evolving landscape of grease production, the selection of Grease Manufacturing Raw Materials is critical. According to a recent market analysis by MarketsandMarkets, the global grease market is projected to reach $4.8 billion by 2026, driven by demand across automotive and industrial applications. However, sourcing high-quality raw materials remains a significant challenge.

Factors such as price volatility and availability can impact production efficiency. Base oils, thickeners, and additives constitute the core of grease formulations. Industry reports indicate that nearly 70% of production costs stem from these materials. It's essential to assess the sustainability and compatibility of these components.

Navigating the complexities of material selection can lead to costly missteps. In 2023, an estimated 15% of manufacturers faced delays due to inadequate sourcing strategies. As the industry moves forward, understanding the nuances behind Grease Manufacturing Raw Materials will be paramount for success.

Grease manufacturing is evolving rapidly. The key raw materials set to dominate the market in 2026 include lithium soap and calcium soap. According to the latest industry analysis by a leading market research firm, these materials are crucial for their performance and high-temperature stability. Lithium greases are favored for their versatility, especially in automotive applications.

Another important factor to consider is base oil quality. PAO (polyalphaolefin) and mineral oils are expected to remain prominent. Industry data indicates that nearly 40% of the grease market uses synthetic base oils due to their superior properties. However, concerns about sourcing and environmental impact arise frequently.

Thickening agents also play a significant role in grease formulation. Clay and silica are common choices, but they face criticism for sustainability. The industry must reflect on this imbalance. Grease manufacturers need to explore new alternatives to ensure they meet both performance standards and the growing demand for eco-friendly options. The shift towards renewable resources is not just a trend; it’s becoming essential.

Base oils are crucial in grease production. They determine the performance and stability of the final product. Recent studies indicate that base oils account for around 70-80% of the total grease formulation. The selection of appropriate base oils can significantly affect properties like viscosity and thermal stability.

The market has seen a shift towards synthetic base oils. These oils often provide better lubrication and higher temperature resistance. According to a recent industry report, the demand for synthetic base oils is projected to grow by 5% annually until 2026. However, the transition raises questions about sustainability. Synthetic oils require more energy for production, leading to higher carbon footprints compared to conventional mineral oils.

Moreover, the rise of biobased oils is noteworthy. These oils, made from renewable resources, are gaining traction. The renewable base oil market is expected to reach $1.5 billion by 2026. However, the production processes are still under evaluation. Many producers face challenges in cost-effectiveness and scalability. As the industry evolves, balancing performance, cost, and environmental impact remains a critical task.

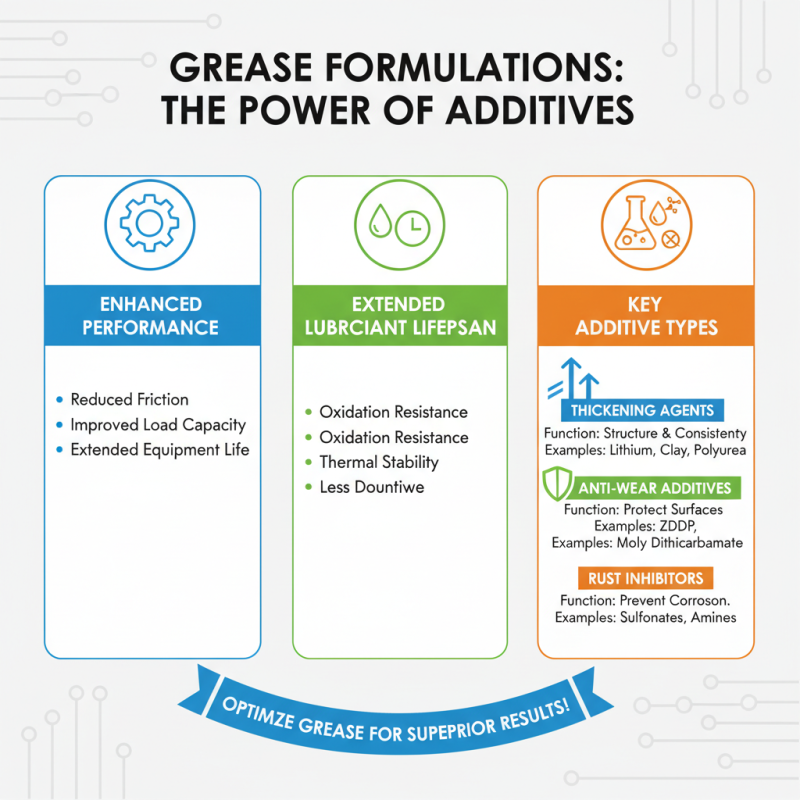

Additives play a crucial role in grease formulations. They enhance performance and extend the lifespan of lubricants. Common types include thickening agents, anti-wear additives, and rust inhibitors. Each additive serves a specific purpose and affects the overall functionality of the grease.

Thickening agents, such as soap or non-soap compounds, give grease its structure. They maintain consistency under varying temperatures. However, choosing the right thickener can be challenging. Sometimes, it may not provide the desired viscosity. On the other hand, anti-wear additives help reduce friction between surfaces. This prevents wear and tear during operation. Rust inhibitors are vital for protecting metal components from corrosion. They extend the lifetime of the grease and the machines it lubricates.

It is essential to balance these additives in a formulation. Over-reliance on one type may lead to reduced effectiveness. For instance, too much thickener can make the grease overly stiff. This may hinder its ability to flow at lower temperatures. Ultimately, understanding the interactions between these additives is necessary. A well-balanced formulation can greatly enhance grease performance.

In 2026, the demand for high-quality grease raw materials continues to rise. This trend highlights the importance of identifying leading suppliers in the industry. Some key materials include lithium soap and calcium soap, which are crucial for effective lubrication. These compounds play a vital role in enhancing grease performance.

The market analysis reveals a mix of established and emerging suppliers. While some suppliers offer reliable products, others struggle to meet quality standards. This inconsistency can impact end-user satisfaction. It's essential for buyers to verify supplier credentials and product specifications. Transparency in sourcing can significantly influence purchasing decisions.

Emerging trends also suggest a shift towards sustainable materials. Biodegradable options are becoming more popular. However, the challenge remains to balance quality with environmental impact. Companies must reflect on their sourcing choices. The sustainability of materials must align with performance needs while maintaining cost-effectiveness. The landscape is evolving, and suppliers will need to adapt to these market demands.

Sustainability has become a crucial topic in grease production. The traditional materials often harm the environment. There's a vital need to explore eco-friendly alternatives.

Biobased oils, derived from plants, are gaining popularity. These oils reduce reliance on fossil fuels. They are biodegradable and safer for the ecosystem. The challenge lies in their performance under extreme conditions. Research and development in this area are ongoing. More data is needed to ensure reliability.

Additionally, recycled materials are a great option. Using waste products can lower the carbon footprint. However, the quality can be inconsistent. Proper processing techniques are essential for success. Manufacturers must balance cost and sustainability.

While the industry moves toward greener practices, some questions remain. Are we ready to make necessary changes? Ongoing dialogue about these issues is crucial for future progress.